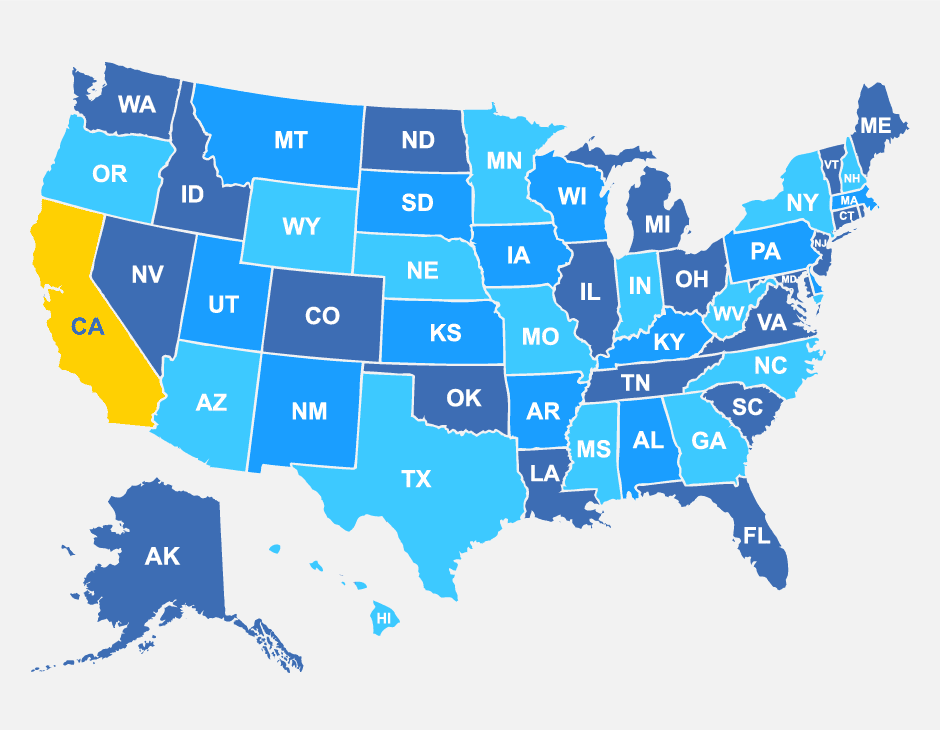

Remote work arrangements are primarily for staff residing in California, because the staff member may need to periodically report to work on-site and because work performed by staff living outside of California may be subject to other state laws, filings, and income taxes and have limitations in available benefits.

In certain situations, however, exempt staff may work remotely outside of California (within the United States) after review and approval from the supervisor, unit leader and HR Policy & Compliance, as well as completion of an Out-of-State Remote Work Criteria Checklist and Remote Work Agreement. Exempt staff are paid on a salary basis and are not eligible for overtime.

Non-exempt staff who are not already working out-of-state will not be allowed to work out-of-state after September 30, 2022. However, non-exempt staff working out-of-state on an approved flexible work agreement prior to October 1, 2022, may be approved to continue working out-of-state at the discretion of their supervisor and HR Policy & Compliance. Non-exempt staff are paid hourly and are eligible for overtime.

Exempt and non-exempt staff are not permitted to work internationally.

If you have questions regarding work outside of California, please contact your departmental human resources professional or your Human Resources Business Partner (HRBP).